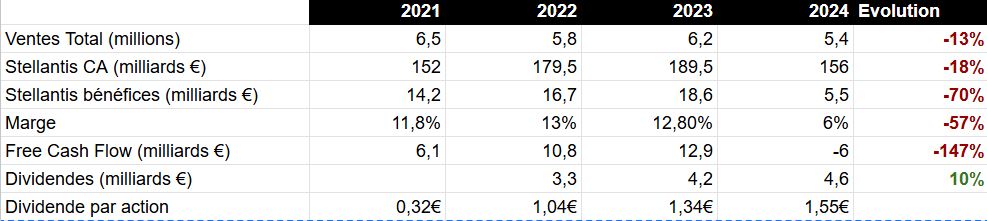

2024 will have been a difficult year for Stellantis. While the Group's financial results fell well short of expectations, with figures in the red, and has also curbed its dividend payout policy. Here's an overview of the year's results and the outlook for 2025.

Numbers in freefall

The year 2024 was particularly difficult for Stellantis, with a marked decline in financial performance. The Group's net sales amounted to 156 billion eurosa fall of 18 % compared with 2023. This decline is largely attributable to lower sales and inventory reduction measures. The Group recorded a 132 % of shipment volumesThis decline was accentuated by the temporary absence of certain models from the range and a reduction in inventories worldwide.

But the most spectacular decline was in earnings. With net profit of 5.5 billion euros, Stellantis saw its results fall by 70 % compared with the previous year, with a margin of 5,5 %. Industrial free cash flow was another dark spot. À -6 billion eurosThe year saw a significant deterioration, as production adjustments and lower revenues put pressure on the Group's liquidity.

Dividend reduction

In the past, Stellantis had distributed record dividends, the Group has decided to reduce this amount for 2025. The dividend per share, which was 1.55 in 2024will be more than halved to 0,68 € per share for the following year, a reduction of almost 56 %. The aim of this decision is to strengthen the Group's liquidity in the face of a year 2024 marked by disappointing financial results and falling free cash flow.

Although the dividend cut may be seen as a precautionary measure, it is nonetheless symbolic of Stellantis' determination to readjust and provide additional resources for the challenges ahead. This decrease is certainly a signal of prudence, aimed at ensuring long-term financial solidity, even if it may disappoint some shareholders.

2025: unclear targets

The outlook for 2025 is equally uncertain. Stellantis expects positive sales growth and on a single-digit operating margin before non-recurring itemsbut without precise figures. The group is also planning a return to positive industrial free cash flowwhich seems essential to boost market confidence after such a difficult year.

However, the objectives remain unclear, and Stellantis will be challenged to achieve its ambitions in an increasingly intense competitive environment, particularly in the face of the growing power of Chinese manufacturers. At the same time, the transition to electrified models continues, with 10 launches expected by 2025 on STLA platforms, but the concrete results of these changes have yet to be proven.

The search for a new CEO, to be appointed in the first half of 2025, could provide new impetus for the group, but uncertainty remains over the future direction of the group, particularly after Carlos Tavares' resignation in November 2024. The Group's long-term Dare Forward 2030 strategy could be reviewedMany observers are waiting to see how the next leader will revive this 14-brand group.